No community industry at this time exists, and just one may well hardly ever exist. DST plans are speculative and acceptable only for Accredited Buyers who tend not to foresee a need for liquidity or can pay for to shed their whole expense.

You are employing a browser that isn't supported by Fb, so we have redirected you to an easier Edition to provde the finest knowledge.

It is usually recommended you meticulously assessment the conditions on the mortgage just before moving forward. If you comply with the terms, you will be directed to the webpage which will request for your e-signature.

♦ On the other hand, when it is recognized that rule 86B applies, then it must be checked that if the registered person falls within the exception given With this proviso

The FBI seized it, rejected his requests to return it and is particularly now moving to confiscate it with no explanation.

Inside their lawsuits, box holders assert the FBI is forcing them to surrender possibly their Fourth Amendment safety towards unreasonable lookups and seizures or their Fifth Amendment suitable not to incriminate by themselves.

When you have been searching, a thing about your browser produced us Imagine you will be a bot. There are several factors this could possibly transpire, which includes: You are a electric power user going by way of this Web site with super-human velocity

Nonthaburi is really a province straight away for the north of Bangkok, but such is the dimensions of Bangkok that it's challenging to tell the place Bangkok finishes and Nonthaburi begins, so I involve Nonthaburi as being a subset of your Bangkok manual.

Ans. You will find several entities throughout India which engage in bogus invoicing i.e. situation of invoices devoid of precise source of products and / or products and services. These entities have an inclination only to acquire credit and pass on credit history to other entities devoid of earning any payment of taxes in cash.

It is among eleven suits submitted by box holders that request the return in their property and courtroom orders declaring the seizures unconstitutional.

d) The registered particular person has discharged his liability in direction of output tax by way of electronic cash ledger in excess of one% of whole output tax liability utilized cumulatively upto the said month in The present monetary calendar year

Applicability: This rule is applicable to registered persons acquiring taxable value of source (apart from exempt provide and zero-rated source) click here in a month which happens to be much more than Rs.50 lakh. The Restrict has to be checked each month ahead of submitting Every single return.

Creator’s viewpoint :- The restriction on utilization will be to be applied on aggregate basis. However, you'll find superior probabilities

Ruling 2004-86 also categorised DSTs as an investment rely on instead of a company entity for federal revenue tax reasons. The following are a few constraints for this classification to hold.

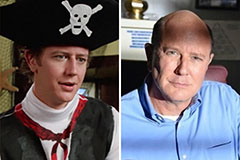

Luke Perry Then & Now!

Luke Perry Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Marcus Jordan Then & Now!

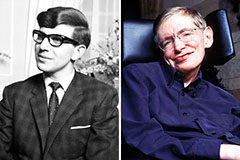

Marcus Jordan Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!